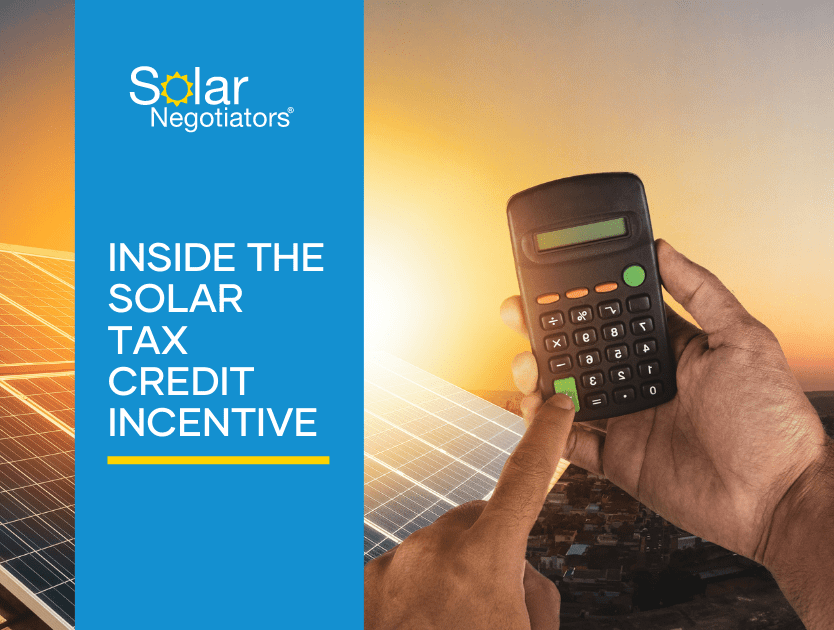

Inside the Solar Tax Credit Incentive

The world has become more invested in solar energy. For this reason, there are additional advantages solar has to offer customers aside from energy savings. The Federal Solar Investment Tax Credit (ITC) is one of the most significant incentives for homeowners. This tax credit can reduce your solar costs and must be factored in when evaluating the cost savings for solar. In this comprehensive guide, we will explain what the solar tax credit is, how it works, and who is eligible for it.

What Is The 2023 Solar Tax Credit?

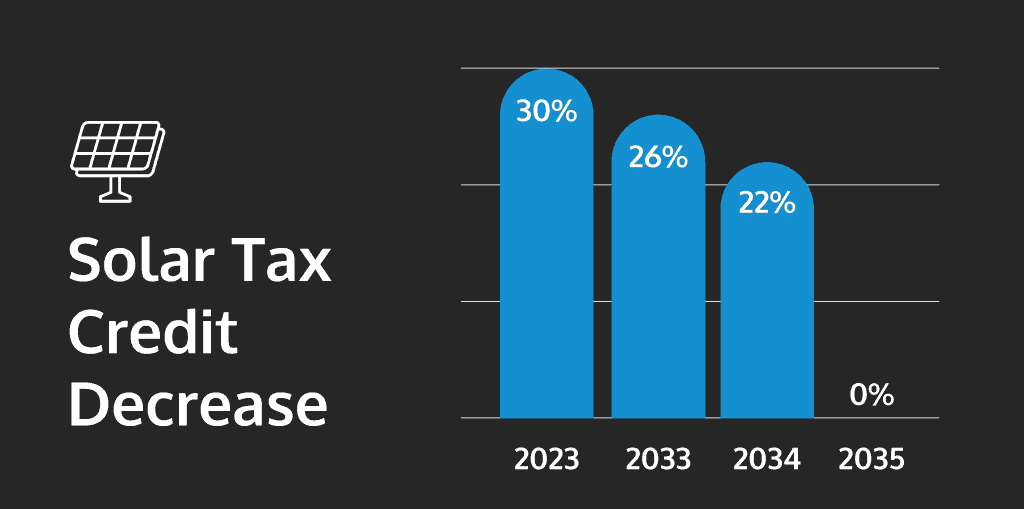

A dollar saved is a dollar earned. Earning a tax credit should be viewed as directly earning savings. Once you’ve gone through the solar installation process in your home, the federal government allows solar customers to deduct a percentage of the cost of their solar system from their tax liabilities. As of 2023, the solar tax credit offers a 30% credit for solar systems installed in that year. By 2033, the solar tax credit will be lowered to 26%, and 22% in 2034 before going away completely in the year 2035.

Solar Tax Credits Explained

The Investment Tax Credit (ITC) also known as the “solar tax credit, is a dollar-for-dollar reduction in the amount of income taxes that you owe. It is available for qualifying taxpayers who install a solar panel system on their property, whether it be residential or business. Please consult your tax professional prior to going solar to see if your tax appetite is large enough to qualify to benefit from the solar investment tax credit.

State Solar Taxes Can Vary State to State

Tax credits don’t have to be just federal; they can come from state incentives as well. Some states offer rebates, tax credits, exemptions, or net metering — which allows solar panel owners to sell excess energy back to the grid at a variable rate.

California State Solar Taxes and Incentives

California is one of the country’s leaders in terms of renewable energy production.

Unfortunately, there are no longer any state–level rebates or incentives for going solar. However, they do offer one of the best net metering programs across the country. You can earn credits that translate to real cost savings by producing power from your rooftop or ground-mounted solar panels.

By working with a qualified solar installer, you can save money on your solar installation and start generating your own clean, renewable energy.

Tax Incentives for Fresno & Bakersfield Residents

What Amounts Can I Get Back from Taxes?

Your tax credit amount will depend on the cost of your solar system and your personal tax liability. The credit is calculated as a percentage of the cost of the solar system and can be used to offset any federal income tax owed by the customer. From our article Calculate Your Solar Payback Period, “This 30% credit is only applicable if you are able to recover funds from a tax credit; please consult your tax professional for verification.”

Talk to Your Tax Accountant

If you are wondering about specific details of how much credit you will get, you should talk to a tax accountant who can professionally calculate the amount you can get credited based on your tax liability and the cost of the solar system.

Am I Eligible for Solar Tax Incentives?

To be eligible for the solar investment tax credit federal program, you must have done the following:

- Purchase a solar system either through cash or financing.

- Ensure the solar system is new. It cannot be used, or refurbished.

- Have the system installed before the year 2035.

- Have a qualifying tax liability. If you don’t have any tax liabilities for the year, you can carry over any unused credit to the next tax year.

- You must use solar for a residence or business.

How to Claim the Solar Tax Credit

To claim the solar tax credit, you need to fill out the IRS Form 5695 and attach it to your federal tax return. When you get your credits, it is a non-refundable credit, meaning that you can only use it to offset your federal income tax liability. Whether you invest in solar for your business or residential home, you will be eligible to claim solar tax credits.

How to Maximize Your Solar Tax Credits

First off, every state will have different incentives. It’s important to work with a professional solar company that can help you navigate the various incentives available to you. They can also assist with calculating what your costs will be and how many solar panels you should have installed on your home.

Taking advantage of all the available incentives is highly recommended if you are available to do so. Some incentives may have limitations on how they can be used or may be subject to certain requirements or restrictions. Additionally, some incentives may only be available for certain types of solar installations, such as residential or commercial systems.

Lastly, it’s important to keep in mind that the 30% federal ITC is set to expire in 2033, so act now if you want to take advantage of this tax credit. The longer you wait, the less money you will be able to save on your solar installation.

Every homeowner’s investment in solar power will vary, and it is important for families to conduct their own research and ask pertinent questions. If your monthly power bill exceeds $150 and you pay federal taxes, investing in solar panels could prove to be a wise financial decision. With a solar payback period that consistently outlasts the system’s lifespan, you can expect to receive long-term returns on your initial investment. To explore your solar panel options and learn how you can both cut electricity costs and contribute to a more sustainable future, consider visiting Solar Negotiators for a quote.

Frequently Asked Questions (FAQs)

Solar PV systems that were installed in 2023 are eligible for a 30% tax credit. How that works is a 30% tax credit is applied to the gross of your system cost. That means you multiply your tax credit percentage with the cost of your system and use that on your federal income tax liability.

Solar tax credits are definitely worth it if you can claim it. It’s essentially a refund that the federal government gives back to you in the form of tax liabilities. The best way to use tax credits is to calculate them into your cost analysis when thinking about going solar. It’ll help to know that there are ways to offset your total investment and is backed by the federal government.

This isn’t a tax refund but instead, it reduces the amount of money you owe in taxes as a credit based on your tax liabilities. Everyone’s tax burden will be different, so it will be important you work out the calculations and find out what your tax liability is.

The IRS solar tax credit is also known as the Federal Tax Credit For Solar Photovoltaics (ITC). This credit can be claimed on federal income taxes for a percentage of the cost of solar photovoltaic (PV) systems.

The tax credit will still be 30% up until the year 2033 where it will decrease to 26%

Recent Posts

Latest Solar Tax Credit News: Bill Signed To Eliminate 30% Solar Tax Credit

Solar Tariffs – Are They Here To Stay?

Solar Backup Solutions: How Do Solar Batteries Work?

Reduce your reliance on the energy grid.

Get Solar In

Your Inbox

Refer friends and get paid in-app

The more referrals you bring in, the higher your earnings.

Earn $1,000 for each referral, and bonuses of up to $1,500 once you hit your 10th referral.