What Happens After the Solar Tax Credit Ends in 2025?

Time is running out for homeowners to claim the residential solar tax credit before it ends December 31, 2025. Anyone who waits until January 1, 2026, might lose up to 30% in federal government tax credit savings. The 30% federal tax credit stands as one of the biggest solar incentives American homeowners have seen, and it will expire at the end of 2025.

Many homeowners want to know if solar makes financial sense after the tax credit expires. We’ll cover post-2025 solar options, including different financing methods, the Section 48E clean energy tax credit, and solar’s value as protection against rising energy costs. We aim to help you find the right solar solution for your home as your lifetime energy partner—whether you install before the deadline or you want to look at options later.

Key Takeaways For The Commercial Tax Credit

The federal solar tax credit landscape is changing dramatically, but solar remains a smart long-term investment for homeowners looking to protect against rising energy costs.

- Solar payback extends but still remains a smart choice: Without tax credits, payback periods will increase, but over the course of a lifetime, homeowners can still enjoy huge cost savings.

- Third-party options continue through 2027: Solar leases and PPAs remain viable as companies can claim Section 48E credits, passing savings on to homeowners.

- Energy inflation protection grows more valuable: With electricity prices projected to rise 15-40% by 2030, solar locks in stable energy costs for 25-30 years.

Even as federal incentives change, solar’s fundamental value proposition—protection against escalating utility costs and energy independence—remains stronger than ever in an era of increasing electricity demand.

Understanding Section 25D and Expiration

Section 25D stands as the most recognized and utilized of residential solar incentives in the United States. Since 2004, it has helped millions of homeowners across the nation adopt alternative solar energy to power up their homes saving millions of dollars.

A Recap Of Section 25D

The Internal Revenue Code’s Section 25D offers homeowners a non-refundable federal tax credit. You can deduct 30% of applicable costs when you install qualified clean energy systems. This substantial benefit covers several renewable technologies. Solar electric panels, solar water heaters, geothermal heat pumps, small wind energy systems, and battery storage.

The One Big Beautiful Bill and its Effect

The landscape changed on July 4, 2025, when President Trump signed the One Big Beautiful Bill. This law reshaped the timeline for renewable energy incentives, especially for homeowners thinking about solar installations.

The Section 25D credits were originally set to stay through until 2032. The tax credit would then drop to 26% in 2033 and 22% in 2034 before ending. Now, the tax credit for residential homes will end December 31, 2025.

Homeowners must have their solar systems installed by December 31, 2025, to get the 30% federal tax credit. Your system needs full installation and grid-connection readiness by this date. Just buying or partially installing won’t cut it.

The bottom line? You need to act before 2025 ends to get the 30% federal tax credit for residential solar!

Start your solar journey now and contact us today!

What happens after the solar tax credit ends in 2025

Will solar still be worth it?

Solar will still be here, and so will Solar Negotiators! As a ‘Lifetime Energy Partner’ to thousands of clients throughout California, we are confident we will be around just that long – a lifetime.

While the residential tax credit will end, solar can still be a viable investment with payback periods between 10-15 years depending on various factors. With 20+ year warranties on solar panels and our lifetime workmanship warranty, you’ll get way more years than the average payback period, rest assured.

Let’s explore some of the options you’ll have after the 2025 solar tax credit expires.

The Rise of Section 48E - The Commercial Solar Tax Credit

There’s good news – another option exists. Section 48E, the Clean Electricity Investment Tax Credit, stays available through 2027 for third-party ownership deals. With leases or Power Purchase Agreements (PPAs), the company that owns the system is able to claim the tax credit and pass savings to you through lower payments. These could directly impact your costs right away, meaning you may not have to wait around to receive your ‘credit’ unlike the 25D tax credits, you’d typically have to wait until the next year when you file your taxes.

Specifically, Pre-Paid PPAs offer a hybrid between direct ownership and PPAs allowing homeowners to get an upfront discount on their systems by offering control to 3rd parties for the first few years of the system. It is the next best thing to getting a tax credit after 2025. We’ll cover more on this further down.

Talk to a solar consultant about your options, today!

What Is Section 48E — The Clean Electricity Investment Tax Credit

Section 48E will be a vital lifeline for solar adoption after 2025 when the residential tax credit ends. Homeowners can still get clean energy incentives through this new provision, which offers a different approach.

What 48E is and how it is different from 25D

Section 48E benefits businesses that own and run clean energy systems. Think of it as a solar tax credit but instead of for residential, it was created for businesses. While businesses collect the tax credits from the government, they can also reduce the immediate costs of solar or batteries for residential homeowners – which effectively allows residential homeowners to benefit from the tax credit.

Section 48E continues until at least 2027 for solar projects. This gives homeowners another way to go solar even after the residential credit is gone.

By no means are we tax professionals! Speak with a tax specialist to review your specific tax liability and how federal tax credits will work for you.

Who Qualifies For Section 48E?

Solar developers, leasing companies, and businesses that install qualifying clean energy systems get the most benefit from Section 48E. They need to own a qualified facility that makes electricity with zero greenhouse gas emissions. These facilities must be subject to depreciation or amortization, which naturally rules out individual homeowners.

This doesn’t leave homeowners out of luck – it just changes your relationship with your solar system. Think of it as renting a luxury car instead of buying one outright—you get the benefits without the upfront cost. (And unlike that luxury car, your solar system won’t lose value the moment you drive it off the lot!)

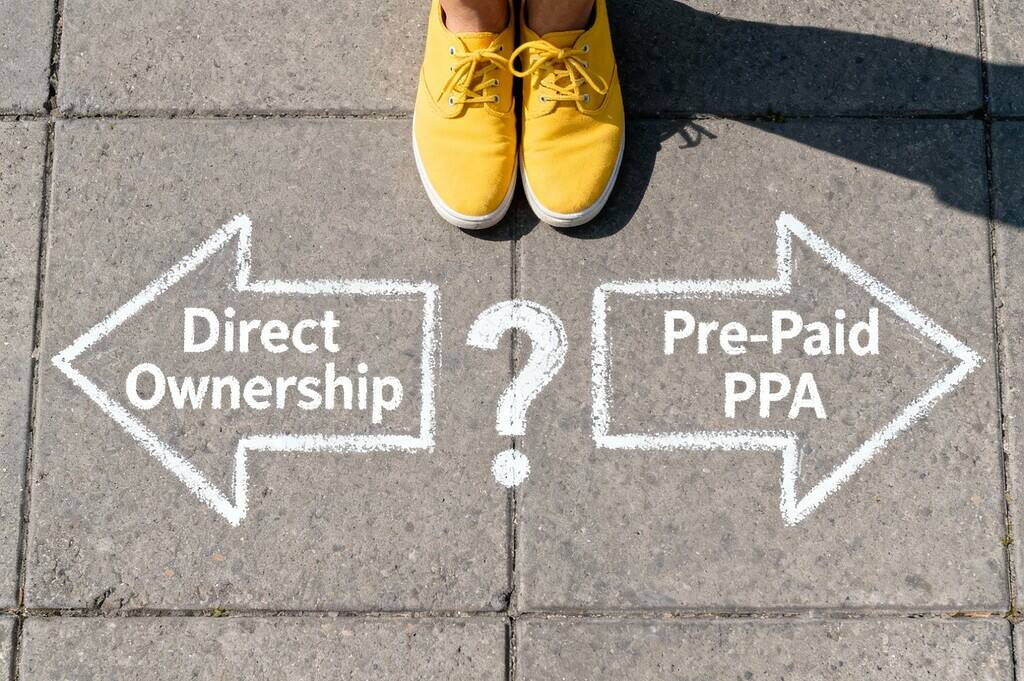

Choosing between buying, PPAs, or Pre-Paid PPAs

Direct Ownership (No Residential Tax Credit After 2025):

Pay in full or finance the system. You get full control, but no federal credit means higher upfront costs and longer payback. Here are the benefits of direct ownership:

- Maximum long-term savings

- No contracts or escalating payments

- Increased home value

- Complete flexibility

- Energy independence

- Transparent maintenance and monitoring

- Freedom to sell or refinance anytime

Traditional Lease or Power Purchase Agreement (PPA):

A third party owns the system and you pay monthly for the power it generates—usually with annual rate increases. It’s low-commitment but doesn’t build ownership or maximize long-term savings.

Pre-Paid PPA (The Hybrid Model):

A newer, smarter option where a specialized business entity claims the 48E tax credit and passes most of it back to you as an upfront discount. You make one Pre-Paid payment (cash or financed) to the the solar installation company, enjoy full system performance from day one, and assume ownership after six years—without ongoing payments.

Solar Negotiators is proud to announce that we can help homeowners explore the benefits of solar while still enjoying tax credit benefits in the form of upfront discounts on systems.

Learn more about our Pre-Paid PPA options for homeowners.

How Solar Is Still An Investment To Protect Against Energy Inflation After 2025

Solar offers much more than tax credits – it protects you from electricity costs that keep going up. The financial advantages will stay strong even after 2025 when federal incentives end for residential systems.

Rising Energy Costs & Energy Inflation

Electricity prices have been increasing on average by about 8% every year. As demand for electricity only ever increases with a growing population, and higher reliability on technology, alternative energy such as solar will always be a great option. With AI data centers needing more power than ever, electricity prices will likely surge even higher.

This matters to your wallet. Solar panels lock in your electricity costs for 25-30 years, with the utmost of predictability (unlike rate hikes from your electric company!). In a decade, it will be likely your neighbors who don’t have solar might pay double while your bills stay the same.

Solar shields you from utility companies that have hiked their transmission and distribution costs by ~100% since 2015, in California.

Protect Yourself Against Power Outages

Climate change makes energy more expensive and less dependable. With yearly fire disasters in California, Public Safety Power Shutoffs (PSPS) occur frequently, especially in more rural areas. Solar systems with battery backup keep your power running during these frequent outages.

New battery systems spot outages right away and switch to your stored solar energy. You can choose which appliances get power, so your fridge, medical devices, or home office stay running.

Conclusion

The end of the residential solar tax credit will be here soon. Yet this change won’t reduce the long-term benefits of going solar. You still have many ways to save on energy costs through direct ownership, leases, or Power Purchase Agreements. Companies can claim Section 48E credits through 2027, making third-party ownership models more appealing and passing those savings to you.

Considering your energy costs over the next 25 years is crucial. Electricity prices are escalating dramatically, with AI data centers now consuming more power than some smaller nations. A solar-powered home can protect you from these rising utility rates, making it a financially sound decision.

You can rush to beat the 2025 deadline or explore post-solar tax credit options. Solar remains a smart choice against energy inflation and rising costs. The federal tax credit may have an expiration date, but energy independence can last a lifetime.

Disclaimer: The information provided regarding the federal solar tax credit is for general informational purposes only and should not be construed as legal, financial, or tax advice. Eligibility for the solar tax credit may vary based on individual circumstances, including income level, tax liability, property ownership, and system installation details. Tax laws and incentives are subject to change and may differ by jurisdiction.

We strongly encourage all homeowners to consult with a qualified tax professional or financial advisor to determine how the solar tax credit may apply to their specific situation. Only a licensed expert can provide guidance tailored to your unique financial profile and ensure compliance with current IRS regulations.

FAQs

Will homeowners still be able to claim the solar tax credit after 2025?

No, the 30% federal solar tax credit for homeowners will expire on December 31, 2025. There is no phase-down period or extension planned after this date.

How will the expiration of the solar tax credit affect the cost and payback period for solar installations?

Without the tax credit, the payback period for solar installations will extend several years, depending on system size and usage. However, solar panels typically last 25-30 years, so homeowners will still enjoy many years of free electricity after breaking even.

Are there alternative ways to benefit from solar incentives after 2025?

Yes, homeowners can still benefit from solar through third-party ownership arrangements Pre-Paid PPAs. These options allow companies to claim the Section 48E tax credit and pass savings to homeowners through lower monthly payments.

With the expiration of the traditional 30% residential solar tax credit (Section 25D), many homeowners think they’ve missed their chance to save with solar—but there are more options beyond 2025. While the homeowner-specific credit is gone, a second tax credit (Section 48E) is still fully active for specialized business entities that can own residential systems and pass those savings back to homeowners.

Will solar still be a worthwhile investment without the federal tax credit?

Absolutely. Solar remains a solid investment due rising electricity costs, and the long lifespan of solar systems. It also provides protection against energy inflation and increases home value.

When is the 48E Commercial Tax Credit Deadline?

The 48E Commercial Tax Credit is planned to be phased out at the end of 2027. Act now to ensure you don’t miss out!

Recent Posts

Reduce your reliance on the energy grid.

Get Solar In

Your Inbox

Refer friends and get paid in-app

The more referrals you bring in, the higher your earnings.

Earn $1,000 for each referral, and bonuses of up to $1,500 once you hit your 10th referral.